Covering all things Real Estate in Southern California. We at The Gallatin Group provide fresh thoughts, never frozen. And we invite your comments as well.. Home buyers / Home sellers / Realtors / Salespeople / Even Lawyers! RIGHT CLICK LINKS TO VIEW ARTICLES

Wednesday, June 28, 2017

Tuesday, February 28, 2017

Wednesday, October 12, 2016

I've moved the Blog

My latest entries:

Zillow Got Better At Zestimates.. So What?:

The Rehabbers Guide to 203K Loans

Our Annual Santa Clarita Schools Report Card

Are Santa Clarita's Bidding Wars Over Yet?

Santa Clarita Really IS The Safest Place To Live

5 Things You Need To Know About the Santa Clarita Real Estate Market Today

Thursday, March 10, 2016

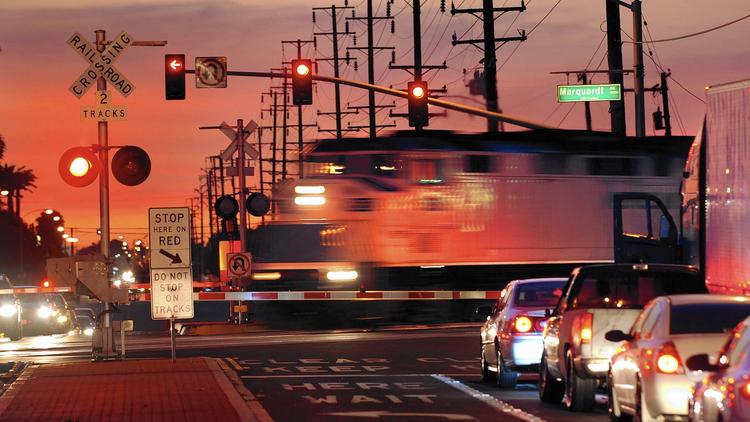

Plains Trains and Restaurants - A Newhall Suggestion Box

They are costly, at $35 million apiece, but that is what government is for... Not Common Core... But that is another story. The tracks also serve to slice Old Town Newhall in half, with homes east of the tracks considered the scariest at night, while businesses on Mains St. enjoy relatively safe, pedestrian traffic at night.

They are costly, at $35 million apiece, but that is what government is for... Not Common Core... But that is another story. The tracks also serve to slice Old Town Newhall in half, with homes east of the tracks considered the scariest at night, while businesses on Mains St. enjoy relatively safe, pedestrian traffic at night.Tuesday, August 4, 2015

Real Estate Investment "Gurus" | A List of The Imposters

Investing takes some up-front education, and patience. But what it requires most is time and money. I stumbled upon an excellent resource for real estate investment advice today. John T. Reed has a website that evaluates virtually every single investment guru/real estate investment seminar that's ever existed. He throws several famous "gurus" under the bus, and explains in detail why their methods are shady or to be avoided.

If you have been toying with the idea of real estate investment, let me offer you 2 absolute truths:

1.) Start small. A $150,000 single family residence rental can teach you more than half of everything you'll need to know. Don't lose your life savings going big, or you won't be able to go home.

2.) Ask yourself if the advice you are hearing seems plausible. If you have to "reach" for a reason to buy into an idea, you are setting yourself up for failure. Many MILLIONS of people have been duped by these infomercial nimrods promising that their brand-new methods will make you a millionaire in just a year or two.

Reed's exhaustive list of the scumbags who've bilked Americans out of millions is frighteningly long, and sometimes contested by those same guru's. They claim Reed just wants to sell his own ideas. Regardless of who is right or wrong, if you are serious about investing, head over to that list of dirtballs, and see if he has a take on one of them. He seems to have a great deal of insight, not to mention, clout.

Friday, July 10, 2015

Real Estate: Trust But Verify

When I try to summarize what makes Santa Clarita..... "Santa Clarita," I would think I can count on 2 things: facts are facts, and opinions are opinions. Take the population figures, for example. We can all agree that the 2010 US census should be a good source, and anyone telling you about the SCV online would use those figures in their research.

So, what is the population of Santa Clarita as of 2010?

Answer: 176,320 people living on 52.71 square miles.

Unless you are Local.niche.com (177,366 people living on 53 sq. mi.)

Or are the City of Santa Clarita (210,000 and 64.41 square miles)

Or are a California-Demographics site (181,557)

Okay, no big deal. These figures get us into the ballpark of what size our town is. But the point here is, this should be a piece of data that is not subject to interpretation. The number was 176,320 five years ago. We appear to be growing at a rate of 1.6%, so the 2014 population by MY estimate, is 187,878. Yes, I too am jumping into this game of wild speculation, and that is the takeaway.

When it comes to real estate, ALL the numbers you see that are NOT on a contract are subject to interpretation, or data gathering error. The only ones you can count on, are on a buyer's agreement. Even something seemingly cut and dry, such as the number of bedrooms and bathrooms a home has, are up for grabs on an MLS. So too, are the numbers of stories, with some realtors listing a home as "single story with loft...." and listing it in the MLS as a one story.

w about square feet in the home? This stat will change over the years as things are done to a property, and it is up to the buyer to compare what they are seeing with what is on the page.

As an aficionado of statistics and general rock-solid number gathering, I like using numbers to tell a story. But earlier I mentioned there is one other method to tell someone what's what: State an opinion. Yelp, Trulia, Zillow and the gang all print out people's opinions about anything you can imagine, including opinions about laws, rules, ethics, expectations, and more. Too often, people rely on the reviews they see. Remember that old adage about how one favorable review is relayed to one other person, but a bad review is relayed to 10? That gets amplified online, where there are a lot of curmudgeons who are messing up my love of statistics telling a story. Thank God, the reviews of our services are all positive on these sites, but I worry about the power of one annoyed client.

The big takeaway here: Trust but verify. Everything. I mean everything. The entire real estate business is predicated on every single person doing what they are supposed to do: buyers, sellers, realtors, inspectors, lenders, appraisers, contractors, escrow agents, brokers, movers, landscapers, attorneys, mortgage brokers.. etc etc... If one person lets something slip, the entire process often comes to a grinding halt.

Pictured at left: 1 Bedroom with loft.

Pictured at left: 1 Bedroom with loft.

Thursday, July 9, 2015

Investors: Throw Your Money A Lifeline

Investors who are under age 50, and are looking for a little more oomph in their portfolio might want to take a second look (or first look, for that matter) at small-market real estate investments. They don't have to be big splashy multi-million dollar properties, to generate some very useful income. One example: parents of students going away to college would do well to buy a multi-unit investment property with 2-4 unit, and have their child live in one of them. Another example: buying a duplex in a smaller town than the one you are in, and seeing immediate cash flow, plus equity building.

I am having great success in several markets. Two different investors are making their 3rd and 8th purchases with me, respectively. The world of investment property can be high risk/high reward... But it can also be low-risk/high reward. That's where I come in.

Give me a call to talk about strategies, and what you are trying to achieve.

The stock market is not a sure thing, and frankly many sectors are overpriced. Real estate? We're just getting started! No bubbles on the horizon here.

Passive income is a beautiful thing, as long as it is as passive as possible...

Call us for a no-obligation chit-chat. (818) 261-8306.